By Alexander Kulakov

Gold and Silver are losing their shine?

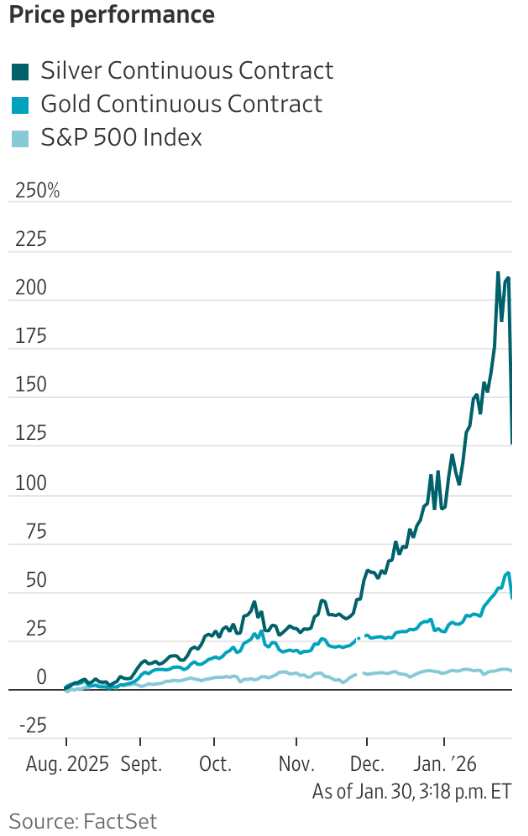

The dramatic selloff in precious metals on January 30, when silver prices fell by 31% and gold futures posted their largest one-day decline on record, exhibits the potential volatility of these assets despite many investors viewing them as safe havens. Gold and silver experienced a prolonged rally driven by fears of inflation in the United States and US currency debasement (i.e., a loss of trust in the USD among international investors). Gold was up 72% in 1 year and 46% in 6 months (up to February 1, 2026), silver rose 165% in a year and 126% in 6 past months whereas S&P500 appreciated by 15% in the past year and 9.5% in the past 6 months. Finally, the market saw a sudden shift in attitude towards precious metals as investors reacted to reports of President Trump’s nomination of Kevin Warsh for the Federal Reserve chair position.

Warsh’s history of prioritizing inflation control over economic growth reassured Wall Street that interest rates might not be cut as aggressively as previously anticipated, leading to a surge in the dollar’s value and a corresponding selloff in gold and silver. Precious metals, like all other commodities, are priced in USD all over the world, so when the dollar appreciates against other currencies, commodities usually lose value in USD. Despite the steepest 1-day declines, both metals still finished January at higher prices than at the start.

The influx of new customers to platforms like BullionVault, which provide physical storage for clients’ precious metal bars, during this tumultuous time indicates strong interest in precious metals, even amid such volatility. The director of research at BullionVault, Adrian Ash, expressed uncertainty regarding the market’s future, emphasizing that the current environment is unlike anything seen in prior years. His comments reflect the unpredictability of investor behaviour, especially as retail participation in precious metals becomes increasingly pronounced, driven largely by ETFs that allow investors to participate in commodity price action without holding physical assets and trade like stocks electronically. This unprecedented event serves as a cautionary tale about the risks and unpredictability of investing in volatile assets, reiterating the importance of an informed and cautious approach to investing, such as holding a balanced portfolio of assets that may allow investors to mitigate price swings.

You must be logged in to post a comment.