By Alexander Kulakov

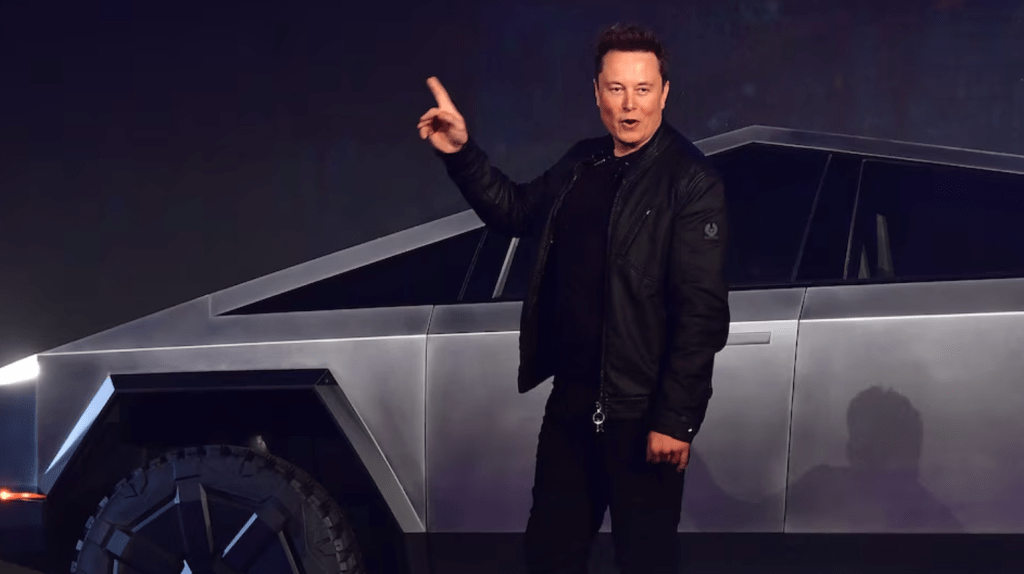

Tesla shareholders have approved an enormous pay package for CEO Elon Musk, worth almost $1 trillion. Around 75% of voting shares supported the plan during the company’s annual shareholder meeting in Austin, Texas.

The new plan gives Musk the opportunity to earn 12 distinct sets of Tesla shares over the next decade, provided the company achieves certain key milestones. These include reaching a market value of up to $8.5 trillion, selling 20 million vehicles, and achieving an annual profit of $400 billion.

Currently, Tesla’s market value is approximately $1.54 trillion, and the company has delivered over 8 million vehicles to date. To get even the first part of his pay, Tesla would need to hit a $2 trillion market cap, which is a big leap.

Musk could also earn shares by meeting other goals, like reaching 1 million robotaxis, 1 million Optimus humanoid robots, and 10 million Full Self-Driving (FSD) subscriptions.

At the meeting, Musk made some bold claims, saying the Optimus robots could “eliminate poverty”, “give everyone amazing medical care,” and even help fight crime. However, Tesla hasn’t released any robots yet, and no release date was announced.

Some experts think the pay plan is too extreme. Two major advisory firms, Glass Lewis and ISS, advised shareholders to vote against it. Musk’s pay plan is also controversial because a Delaware court ruled that his 2018 pay deal was unfair and had to be cancelled. Musk has appealed that ruling, and the case is still being reviewed.

However, the Tesla board supported it, stating that it would motivate Musk to stay focused on the company’s future. Besides running Tesla, Musk also leads SpaceX, xAI, Neuralink, and The Boring Company, and is heavily involved in politics. Some researchers argue that his political activity has harmed Tesla’s sales in the U.S. and Europe.

Musk has hinted in the past that if this pay package is not approved, he might resign as Tesla CEO, which would hurt shareholders’ value. Investors in Tesla understand that the company is valued not as an automobile company but as an AI innovation play, and that their investments in Tesla will turn a profit only if the company succeeds in bringing those innovations (currently in development) to market at scale. The board believed that without Musk as CEO, that would not be possible.

This is an extreme example of how valuable a leader of an innovative company can be to shareholders in the current race to find commercial applications of AI.